The Million-Dollar Question Every Vet Practice Owner Is Asking: "Am I Leaving Money on the Table?"

The Uncomfortable Truth About Veterinary Practice Profitability

Picture this: You've just finished a 12-hour day treating everything from routine checkups to emergency surgeries. You're exhausted, fulfilled, and... worried about your practice's financial health.

Sound familiar?

You're not alone. 73% of veterinary practice owners admit they struggle with pricing decisions, according to recent industry surveys. They're caught in a painful dilemma:

- Price too low → Watch profits evaporate despite working harder than ever

- Price too high → Risk losing clients to competitors down the street

But here's what successful practice owners know that struggling ones don't: The difference between a thriving practice and a failing one often comes down to just 3-5 percentage points in profit margins.

That's it. A few percentage points separate financial freedom from financial stress.

The Numbers That Will Make or Break Your Practice

The Profit Margin Reality Check

Let's cut straight to the chase. If your veterinary practice isn't hitting these benchmarks, you're in trouble:

- The Sweet Spot: 15-20% profit margins

- Warning Zone: 10-15% (survivable, but not thriving)

- Danger Zone: Under 10% (time for immediate action)

The American Veterinary Medical Association (AVMA) reports that top-performing clinics consistently achieve 25% margins. What's their secret? They've cracked the code on strategic pricing.

The Revenue Reality: What Each DVM Should Generate

Here's a number that might shock you: A single full-time veterinarian should generate $400K-$600K in annual revenue. Elite practices push this to $700K+.

Are your DVMs hitting these numbers? If not, you're sitting on untapped potential.

The $200K Question: Can Vets Really Earn This Much?

The answer is a resounding YES – but only if you understand the game:

The Three Paths to $200K:

- Practice Ownership (the most reliable path)

- Specialization (oncology, surgery, emergency care)

- High-Volume Excellence (optimized systems + smart pricing)

Most associate vets plateau at $90K-$130K because they're working in practices that haven't optimized their financial engine.

The Hidden Profit Killers Draining Your Practice

COGS: The Silent Revenue Thief

Cost of Goods Sold should never exceed 25% of revenue. Yet many practices find themselves at 30%+ because they're:

- Carrying more than 30 day supply of products

- Not negotiating with vendors

- Failing to track inventory properly

- Carrying redundant products (especially parasiticides)

The Debt Trap

Many veterinarians start their careers carrying six-figure student loans, yet earn far less than needed to pay them down quickly. This “debt trap” creates stress, limits growth, and makes financial tools that boost profitability more critical than ever.

The Game-Changing Solution: Why Smart Practices Are Going Digital

The Problem with "Gut Feeling" Pricing

Too many practices still price like it's 1999:

- Copying competitors' fees

- Adding random markups

- Hoping for the best

This approach is financial suicide in today's competitive landscape.

Enter: Veterinary Pricing Software

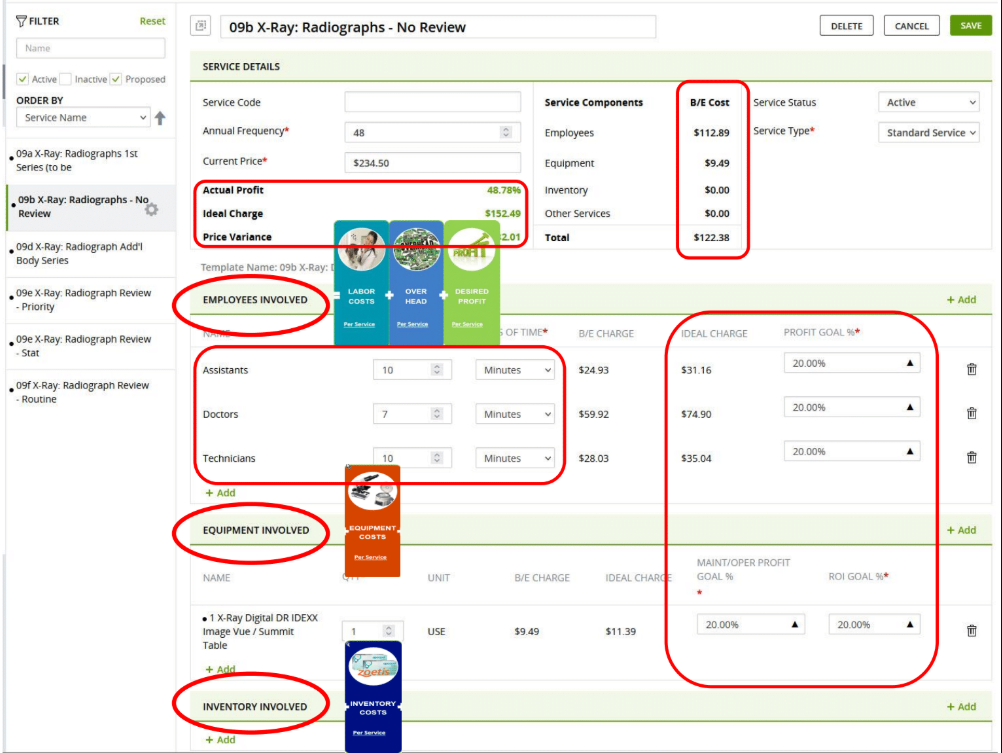

The practices dominating their markets aren't just better at medicine, they're better at business. And their secret weapon? Veterinary pricing software that provides:

Precision Pricing

- Data-driven fee schedules that maximize profitability

- Real-time margin tracking on every service

- Automatic adjustments for inflation and market changes

Revenue Intelligence

- Track performance per DVM, per service, per visit

- Identify your most profitable services

- Spot revenue leaks before they drain your practice

Growth Modeling

- "What if" scenarios to test pricing strategies

- Forecasting tools to plan expansions

- Benchmark against industry leaders

Your 90-Day Profit Transformation Plan

Month 1: Audit and Benchmark

- Calculate your current profit margins

- Analyze revenue per DVM

- Can you Identify your top 20% most profitable services

Month 2: Implement Strategic Pricing

- Deploy veterinary pricing software

- Restructure fee schedules based on industry and your data

- Train staff on value communication

Month 3: Optimize and Scale

- Monitor KPIs weekly

- Adjust pricing based on results

- Plan for growth and expansion

The Questions That Keep Practice Owners Up at Night (Answered)

Q: "What if clients can't afford higher prices?"

A: Studies show that value communication matters more than price. Clients will pay premium prices for premium care when they understand the value.

At the same time, practices can ease financial concerns by offering flexible payment solutions such as Buy Now, Pay Later (BNPL) plans or third-party financing. These options allow clients to move forward with needed care immediately while spreading out the cost over manageable payments. By combining strong value communication with payment flexibility, you remove barriers to care, strengthen client loyalty, and maintain healthy profitability without discounting your services.

Q: "How do I know if my practice manager is worth their salary?"

A: According to the Veterinary Hospital Managers Association (VHMA), total management compensation should fall within 3–5% of topline revenue. In smaller practices, this percentage may be dedicated entirely to a single practice manager often in the $60K-$90K range. In larger hospitals with multiple layers of leadership, administrative, or accounting oversight, that same 3-5% may need to be distributed across several positions. Regardless of structure, your management team should generate clear ROI through improved efficiency, stronger systems, and better overall practice performance.

Q: "What's a realistic EBITDA target?"

A: Aim for 15-20% EBITDA margins. Private equity groups actively seek practices hitting these numbers (hint: they know something about profitability).

Q: "Can small practices really compete with corporate chains?"

A: Absolutely. Independent practices that leverage smart pricing strategies and personalized client relationships often outperform corporate chains delivering higher profitability and stronger client satisfaction.

The Bottom Line: Your Financial Future Starts with One Decision

Every day you delay optimizing your pricing strategy, you’re literally giving money away. The difference between a 10% EBITDA practice and a 20% EBITDA practice often comes down to better systems, smarter pricing, and data-driven decisions.

The practices thriving in today’s market aren’t just lucky; they’re strategic.

Ready to stop guessing and start growing? Your ideal profit margins are waiting; you just need the right tools to unlock them.